Budgeting Basics

Most people start budgeting the same way: open a blank spreadsheet, feel overwhelmed, and quit. Let’s make it easier. A good budget isn’t about tracking every penny, it’s about building a plan you can actually follow.

In this blog series, we’ll walk through the four stages of budgeting and break down each one in a way that feels accessible and easy to follow.

Step 1: Understand what you spend

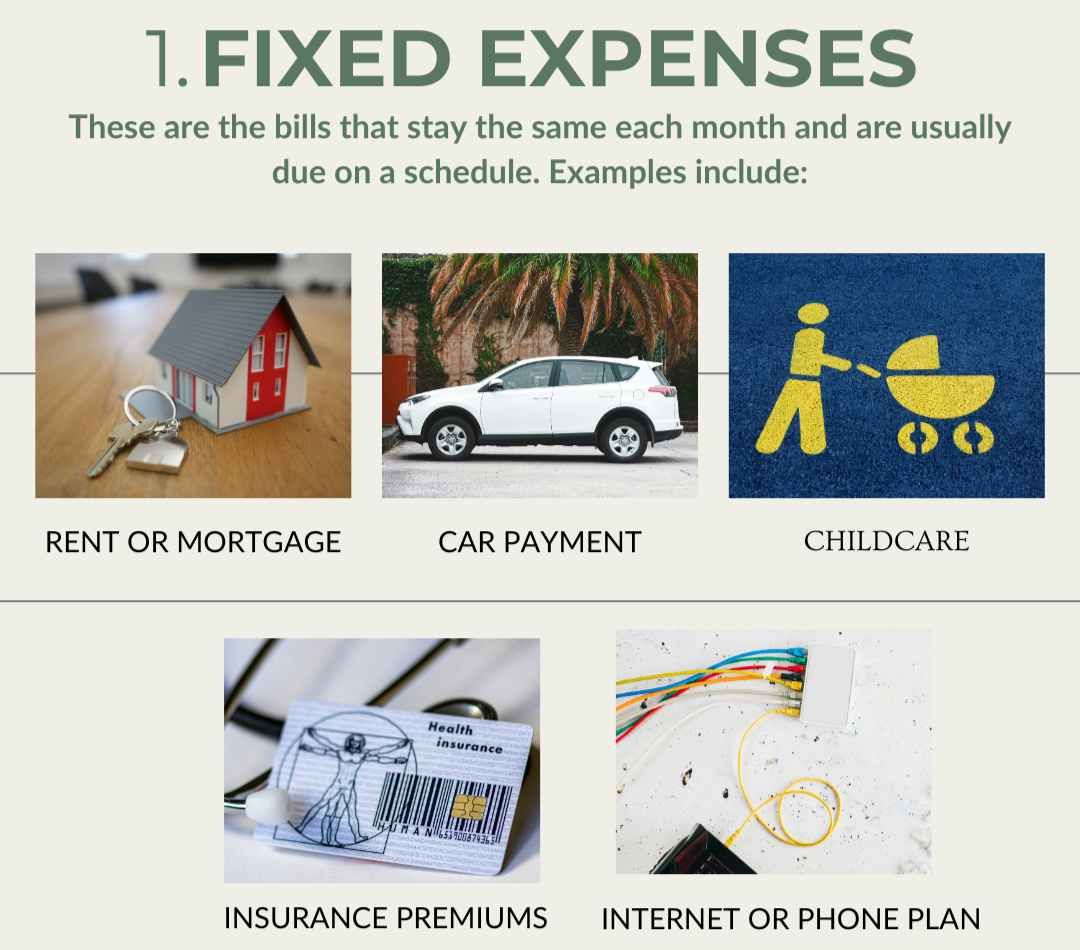

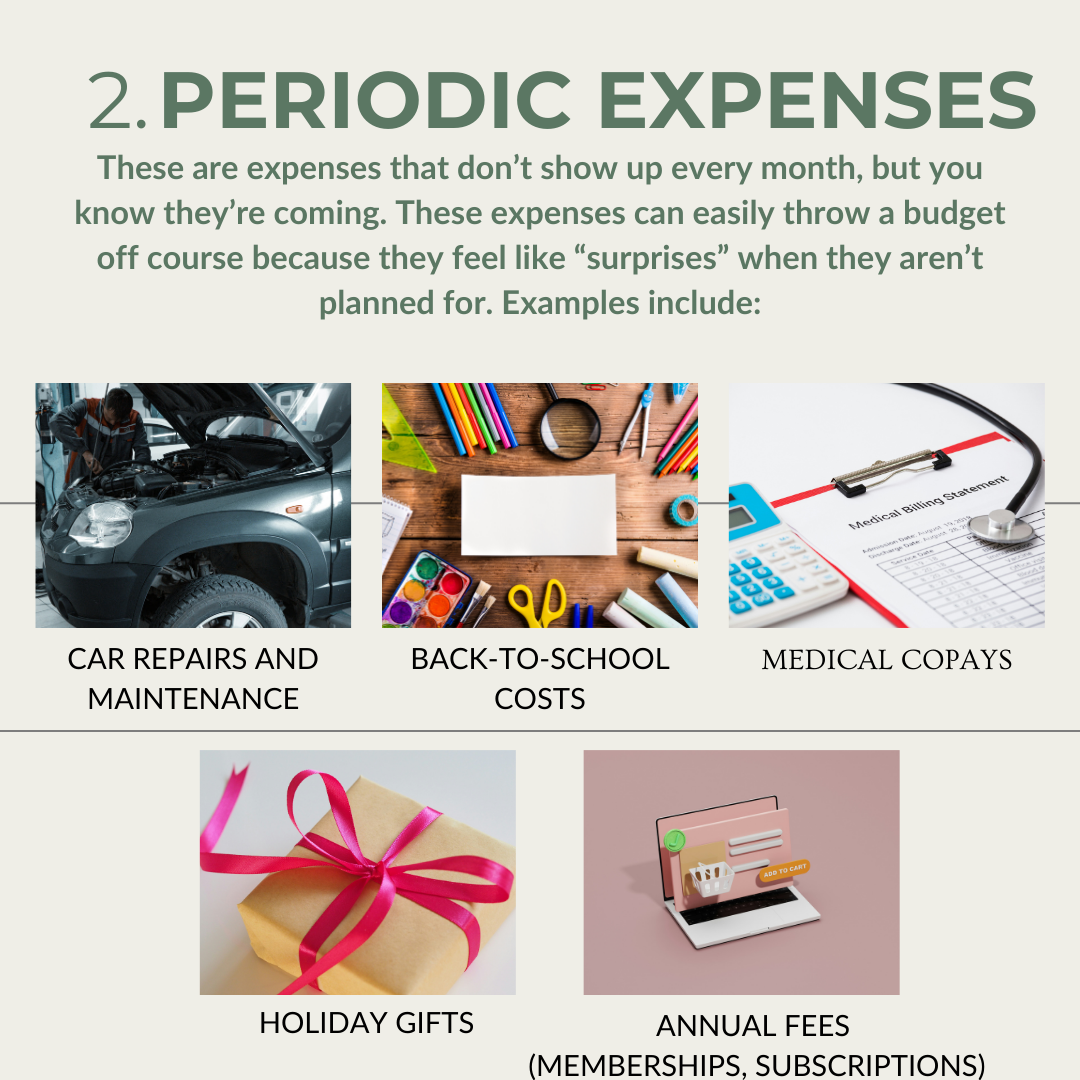

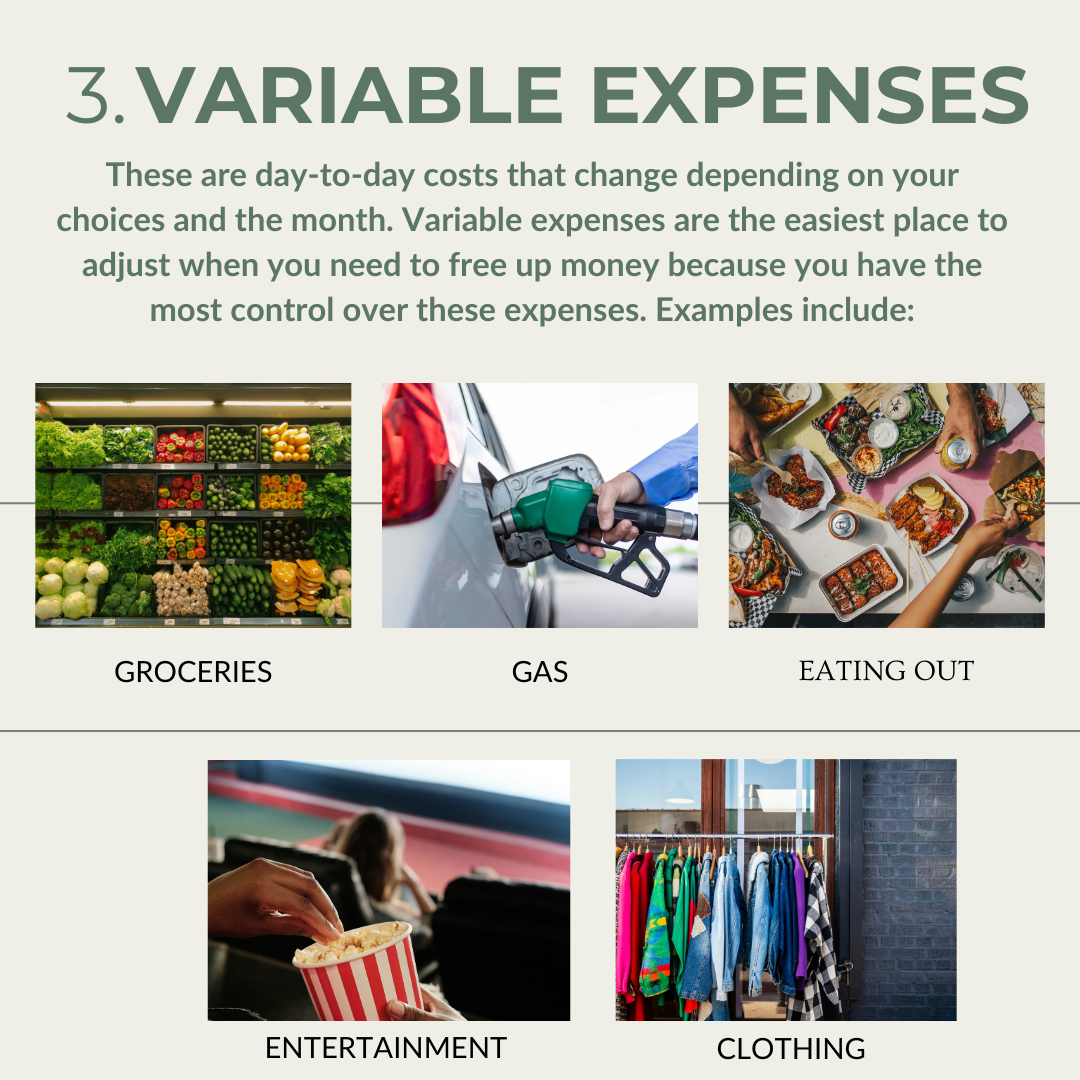

Before you can build a budget, you need a clear picture of where your money is going. The easiest way to do that is to sort your spending into three buckets:

Now that you know the difference between fixed, periodic, and variable expenses, you’re ready for the most useful next step: sort your own spending.

Download the worksheet below and map your recent expenses into the three buckets. It’s designed to be quick, no perfect tracking needed. Use the last 30 days of transactions (bank + credit card), label what you see, and you’ll have a clearer picture of where your money is going and what you can plan for next.

Download and Complete: Understand What You Spend (Fixed, Periodic, Variable) Worksheet

Up next in our budgeting series? Step 2: Pick your Priorities.