College Savings, Explained (Part 2)

The 529 Practical Playbook

This post is part of a 3-part series inspired by our recent Smarter Savings Association webinar on 529 plans.

Part 2: The practical playbook (you are here)

How to start, contribute, and use a 529 well

A 529 is a state-sponsored education savings account that can offer tax advantages when the money is used for eligible education expenses. This playbook focuses on the “what to do next” steps, without assuming you have unlimited money, perfect timing, or a predictable college path.

Step 1: Start with a goal that fits real life

Instead of trying to “fully fund college,” choose a purpose you can commit to, such as:

covering books and supplies

reducing how much you may need to borrow later

building flexibility for different education paths (college, trade programs, etc.)

A workable plan beats a perfect plan that never gets started.

Step 2: Know the two roles

Every 529 has:

Account owner: the adult who controls the account and decides when money is used

Beneficiary: the student the money is intended to support

In most cases, the account owner keeps control even when the beneficiary becomes an adult.

Step 3: Choose where to open the account

In general, you can open a 529 in any state, you are not limited to your home state. A practical way to choose is to compare:

whether your state offers a state tax benefit for contributions (if applicable)

overall fees and ease of use (simple contributions, easy access, clear statements)

investment options that are understandable and easy to maintain

If your state offers a meaningful tax benefit, that is often a reasonable place to start.

Step 4: Pick an investment approach you can stick with

Many plans offer two common styles:

Age-based options: automatically become more conservative as the beneficiary gets closer to college (hands-off)

Static options: you choose a mix and review it periodically (more hands-on)

Align your approach to your timeline and your comfort level, then keep it simple enough that you will actually follow through.

Step 5: Set up contributions so they happen even when life is busy

The most effective contribution plan is usually the one you do automatically. A few ways families can contribute:

monthly automatic transfers from a bank account

“round-ups” or small recurring amounts (if available)

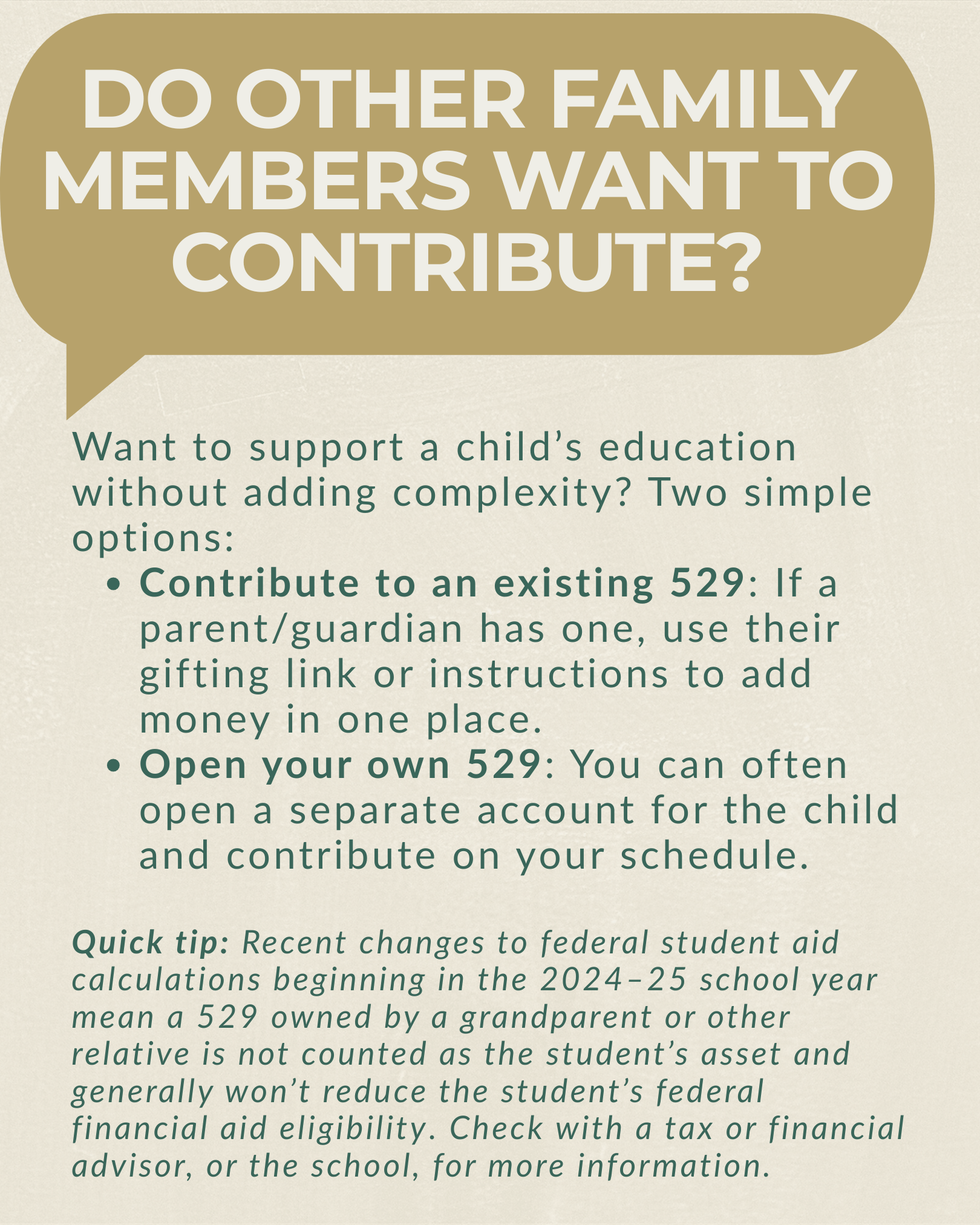

periodic gifts (birthdays/holidays) from family members

Even small, steady contributions can matter over time, because 529 earnings can grow without annual taxes while in the account (“tax-deferred growth”).

Step 6: Know what “qualified education expenses” generally includes

When you use 529 funds for eligible education costs, withdrawals can be tax-free at the federal level.

Qualified expenses often include tuition and commonly required costs tied to enrollment, including at trade schools and apprenticeship programs. In some cases, 529 plans can also help pay for K–12 tuition and student loan repayment, within limits. Wondering whether your institution is 529 eligible? You can use this helpful tool to search.

Practical tip: when the time comes, match withdrawals to actual expenses and keep records (receipts, billing statements) so everything lines up cleanly.

Step 7: If plans change, you usually still have options

A common hesitation is: “What if my child doesn’t go to college?”

Most plans allow options like changing the beneficiary to another eligible family member. And newer rules may allow some unused 529 funds to be rolled into a beneficiary’s Roth IRA if specific requirements are met (talk to your tax or financial advisor about the details if this applies to you).

Common mistakes this playbook helps you avoid:

waiting for a “perfect” amount before starting

choosing a setup that is too complicated to maintain

forgetting to check for possible state tax benefits

not coordinating contributions when multiple relatives want to help

withdrawing funds without confirming the expense is eligible

Next in the series: Part 3 - a 529 expert answers your top questions. We’re turning your questions into clear, straight answers with a 529 expert so you can move forward with confidence.