Is a Roth right for you?

A quick guide to understanding Roth accounts and when they make sense.

A “Roth” simply tells you when you pay taxes.

Traditional IRA/401(k): Tax break now, pay taxes later.

Roth IRA/401(k): Pay taxes now, take money out tax-free later (if you follow the rules).

Why do people choose Roth?

Tax-free in retirement: Contributions + growth can come out tax-free.

Less guesswork: You’re not relying on future tax rates.

Extra flexibility (Roth IRA): You can withdraw what you contributed anytime, tax- and penalty-free.

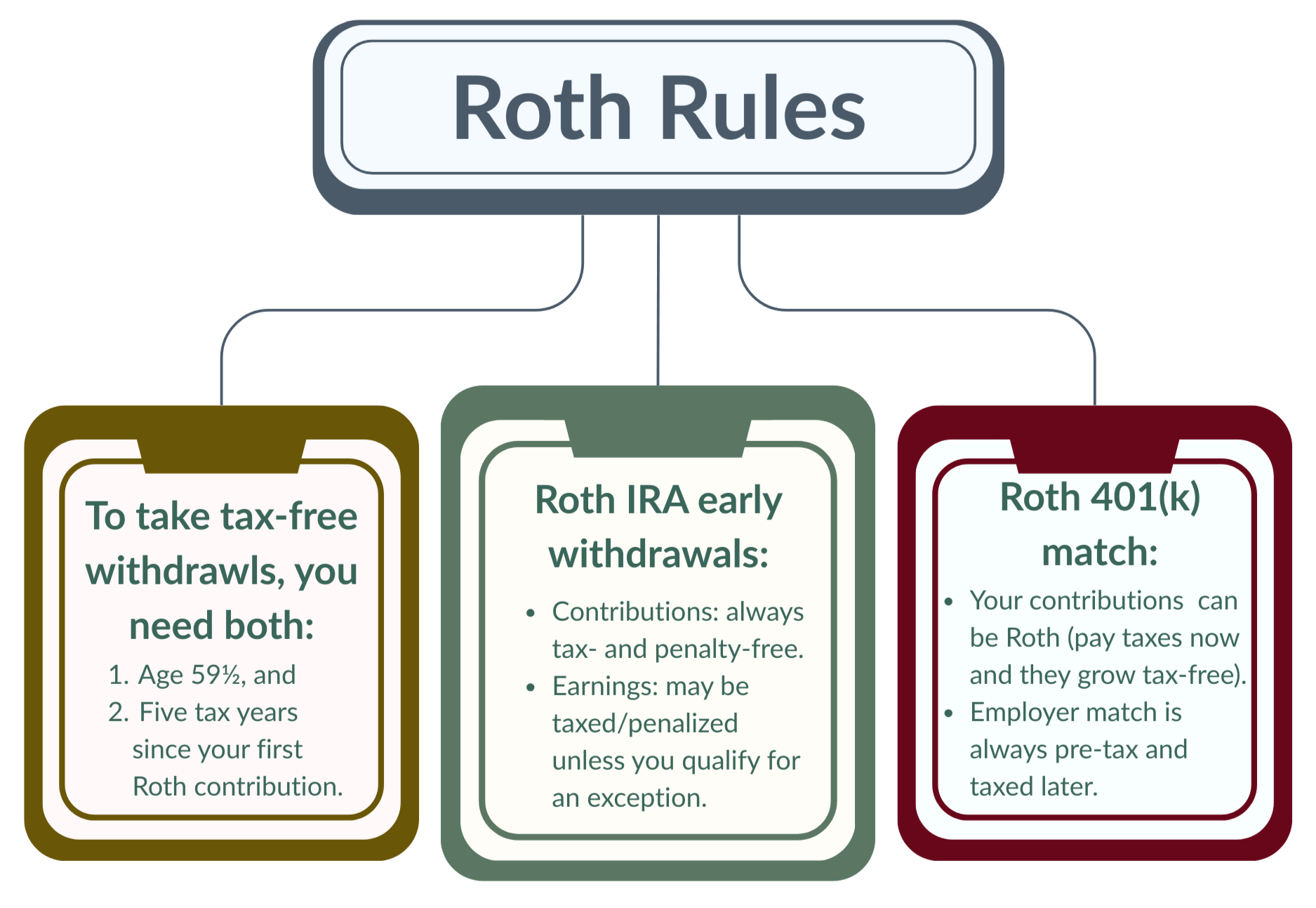

What are the basic rules of Roth?

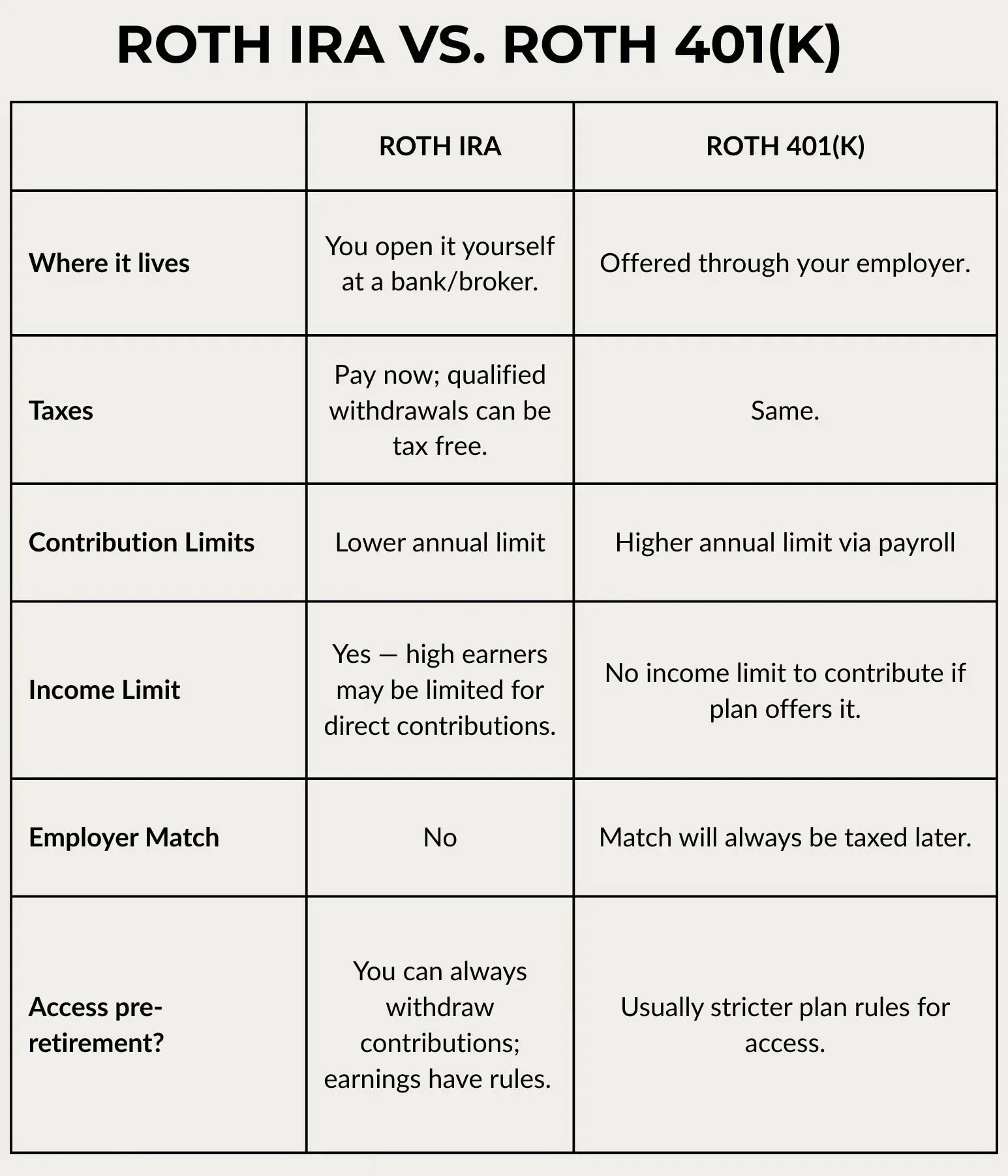

Here’s how the two main Roth account types compare at a glance.

Plans differ—check yours for details.

When does Roth work well?

You expect your tax rate to be the same or higher later.

You’re early in your career or have a long growth runway.

You want tax-free flexibility in retirement.

When Traditional Can Make Sense

You expect a lower tax rate in retirement.

You need the tax break today.

You’re saving a lot and want to reduce taxable income.

Common Myths

“Roth is always better.” Depends on your tax rate now vs. later.

“I can’t touch Roth money until 59½.” You can always withdraw Roth IRA contributions.

“My Roth 401(k) match is Roth.” The match is pre-tax.

A Simple Way to Choose

Think of two buckets:

Tax later (Traditional): Save taxes now, pay later.

Tax-free later (Roth): Pay taxes now, enjoy tax-free withdrawals.

Many people fund both to stay flexible in retirement.

Understanding how Roth works gives you another simple, practical tool to make smart money moves, today and in the future. Become a member to download our one-page Roth guide and quick checklist.

This is general education, not tax or investment advice. Consider consulting a tax professional for personal guidance.